The DTC space continues to grow stronger by the year, with DTC sales expected to reach $161.22 billion by 2024. As competition intensifies across direct-to-consumer categories, companies are leaning on a wide range of strategies to continue to compete. We’ll take a look at these categories in closer detail and examine a few companies with the help of insights from Charm.io’s ecommerce intelligence platform to learn how they are growing and what strategies they may be prioritizing to accomplish their goals.

Here are some of the DTC categories that are leading the charge:

- Makeup and Cosmetics

- Activewear

- Hair Care

- Vitamins and Supplements

- Dog Supplies

Makeup and Cosmetics

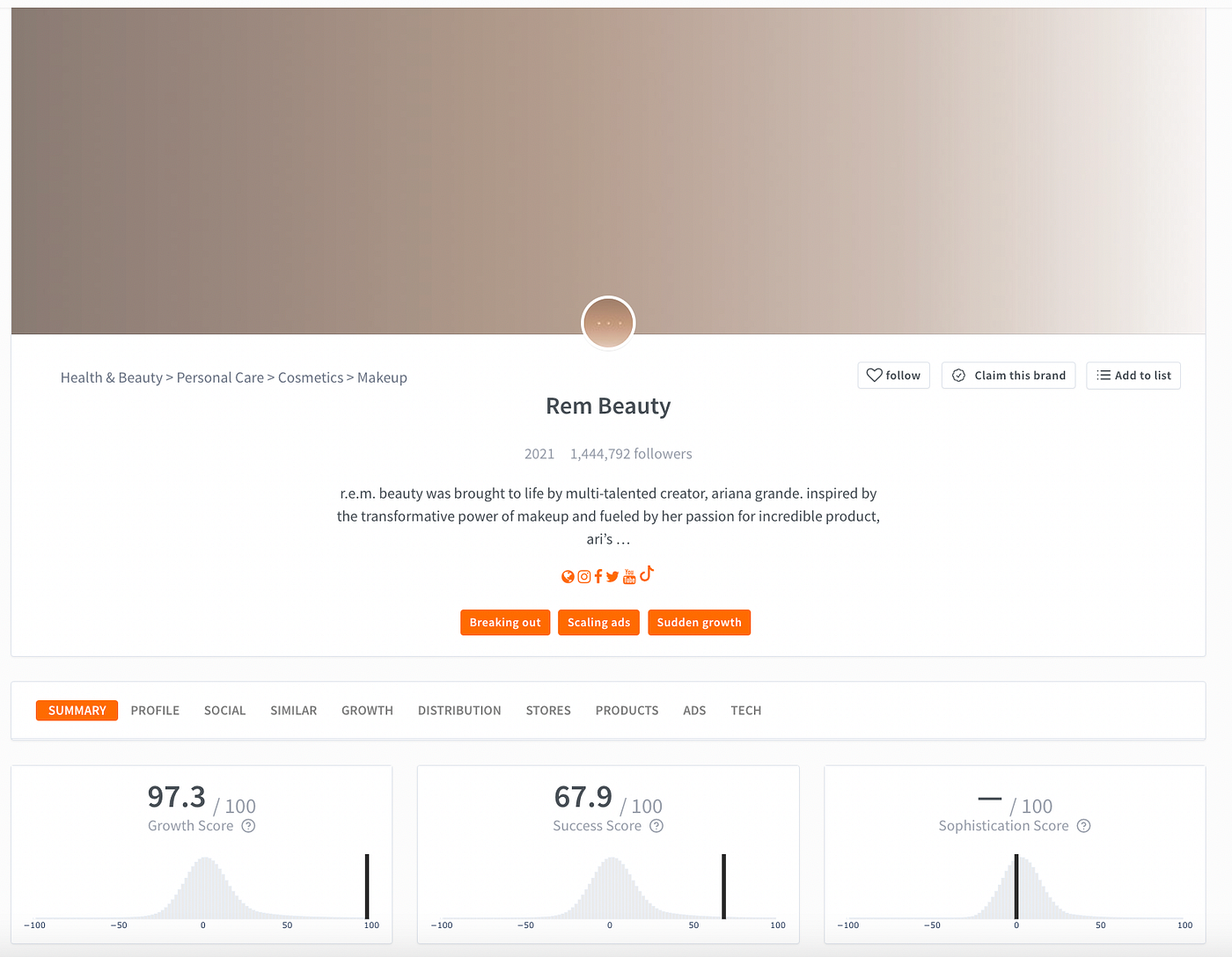

The beauty industry brings in over $100 billion in revenue worldwide, with over $17.09 billion in online sales. It’s no wonder that of the DTC categories, makeup and cosmetics continues to be a top performer. Companies like R.E.M. Beauty, the brand started by Ariana Grande, are becoming immensely popular due to their unique branding, packaging, and social media strategies. According to Charm.io’s platform, R.E.M. is successfully leveraging its social media channels, resulting in a 97.3 (out of 100) Instagram growth score and over 1.4 million followers on Instagram alone.

Ohora is another exciting brand in the makeup and cosmetics segment. Based in Hong Kong, the company focuses on providing professional nail art at home. Ohora has a 97.7 growth score and sits in the 94th percentile for Facebook, 94th for Instagram, and 90th for advertising. It also stands out from the other players in our top list based on the number of tech tools Ohora’s team uses to accomplish their business goals. Ohora has 54 technology solutions in its arsenal to assist with order recoveries, retargeting, marketing analytics, email marketing, social proof, content marketing, customer retention, pricing, messaging and chat, workflow automation, and more.

Activewear

Of the DTC categories, activewear has been wildly successful. Some credit goes to the increasing demand for athleisure — clothes worn for athletic purposes or casually. The popularity of athleisure continues to increase after booming during the pandemic. WFH employees naturally swapped work attire for comfort clothes while away from the office. This trend provided ample opportunities for brands in the activewear segment to capture a larger market share by reaching a broader range of consumers.

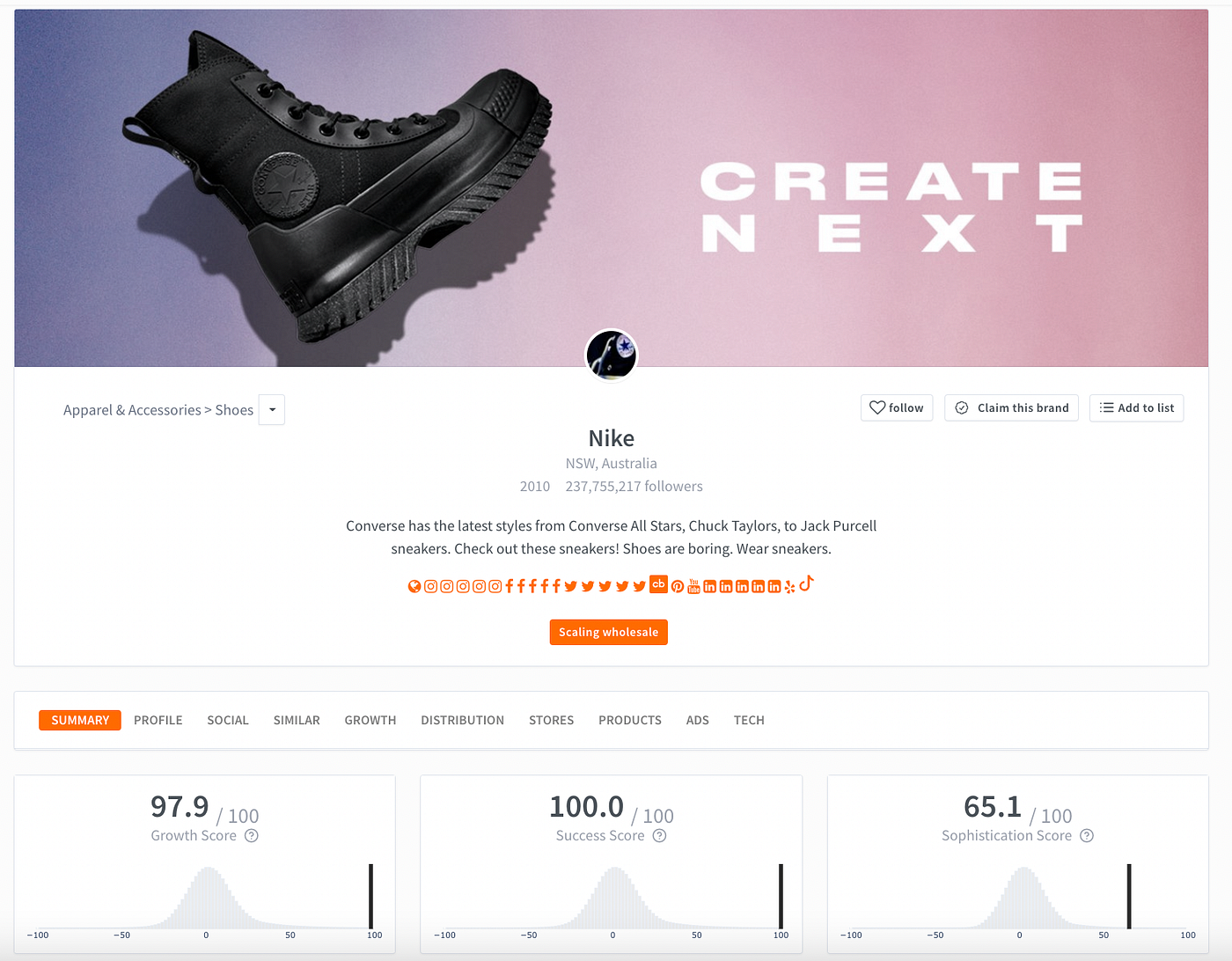

When you consider that Nike’s DTC sales jumped from 15% of the company’s total revenue in 2010 to 40% ($44.5 billion) in 2021, it is easy to see the trajectory of DTC in activewear. Despite being an established brand, Nike continues to innovate and grow. Charm.io insights place Nike’s growth score at 97.9 (out of 100) and its success score at 100.0. The company’s Instagram is doing particularly well, sitting in the 97th percentile, and it continues to commit to ad spending, increasing its quantity of ads over the past year by 131%. Nike’s tech suite of 32 solutions includes tools for catalog and image galleries, messaging and chat, navigation and search, marketing analytics, and retargeting.

Hair Care

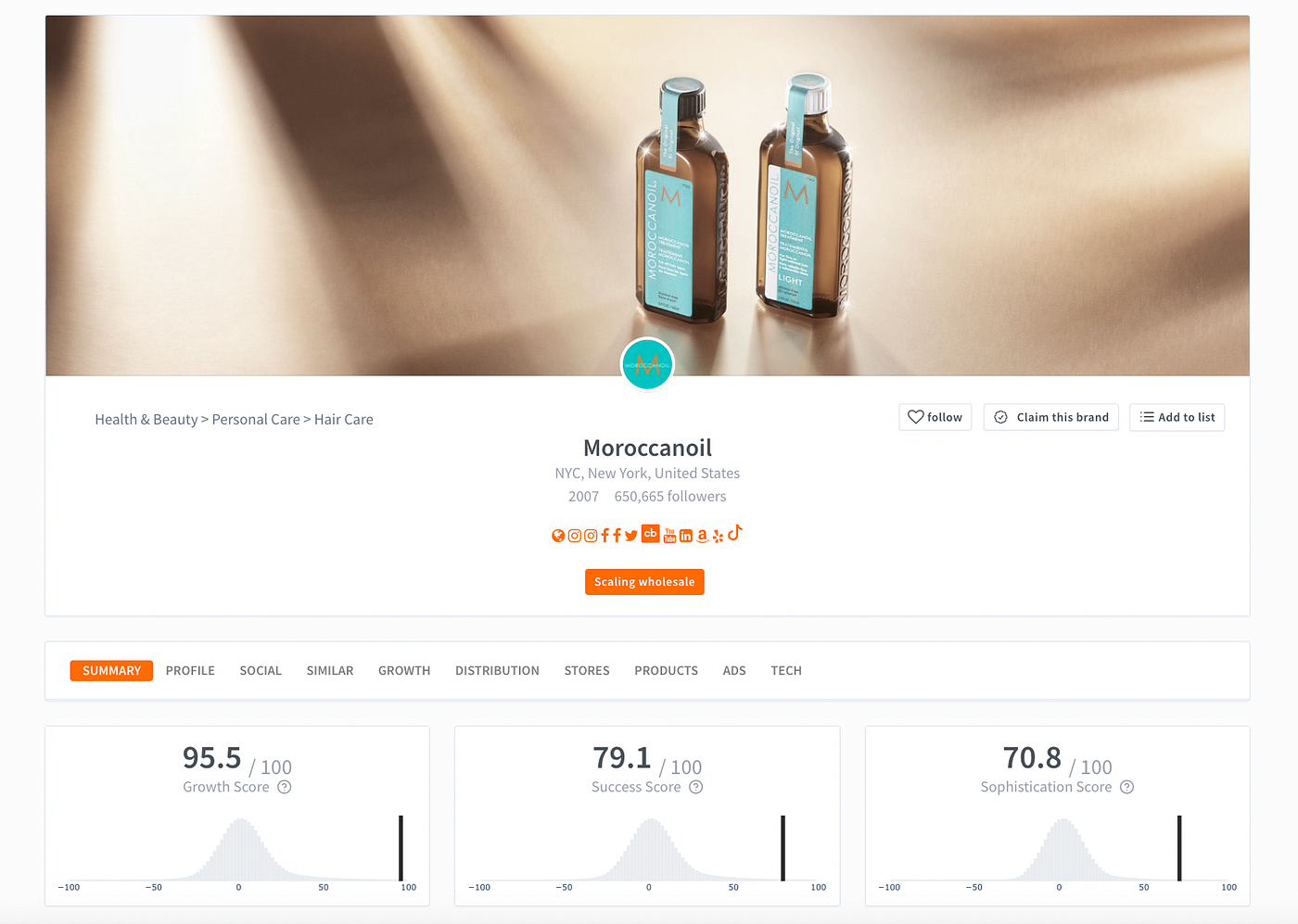

Moroccanoil serves as an excellent example of how well the DTC hair care segment is doing, showcasing a 95.5 growth score. The global brand sits at the 93rd percentile on Instagram and 90th for website traffic. According to Israeli tech guru Hila Shitrit Nissim, Moroccanoil uses localization to offer an excellent online shopping experience to customers worldwide in 40 languages. It makes sense that of the 16 tech tools detected by Charm.io, Moroccanoil is leveraging tools for shipping rates and labels as well as ads and retargeting that support their localization and personalization strategies.

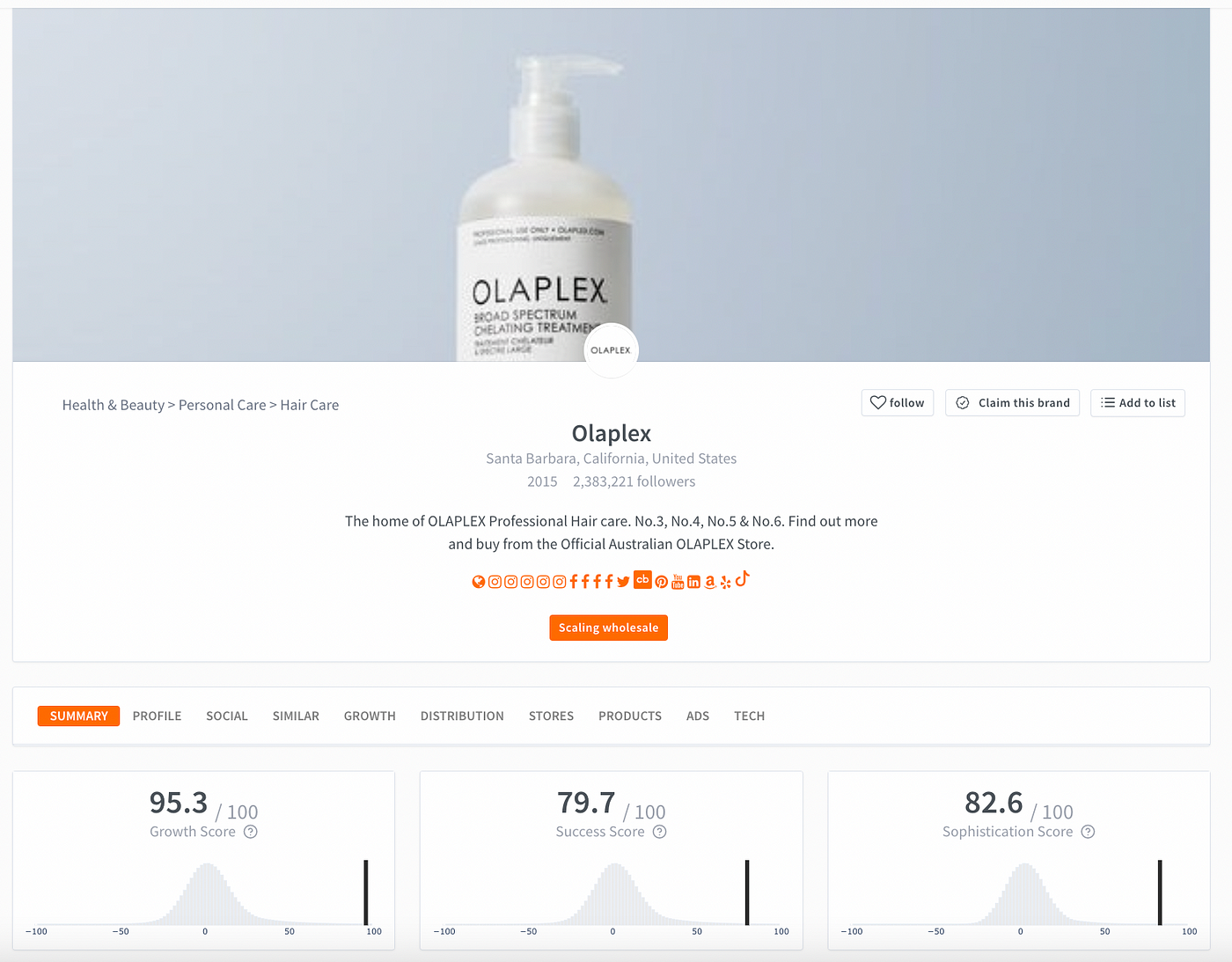

Olaplex offers another exciting case study. The Santa Barbara company was founded in 2012, and a decade later, it is standing tall with a 95.3 growth score. Instagram (94th percentile) and website traffic (94th percentile) are primary contributors to the brand’s outstanding score. Olaplex also sports an impressive array of 68 tech solutions supporting a wide range of business processes and customer experiences. The business’ tech suite includes tools for online and SMS notifications, customer retention, shipping rates, and labels, live chat, bundling, upselling/cross-selling, affiliate marketing, workflow automation, FAQs and search, CRM, and AdRoll remarketing. There is no doubt that Olaplex’s ability to leverage automation and CX tech plays a role n the company’s ability to sustain growth for the past 10 years.

Vitamins & Supplements

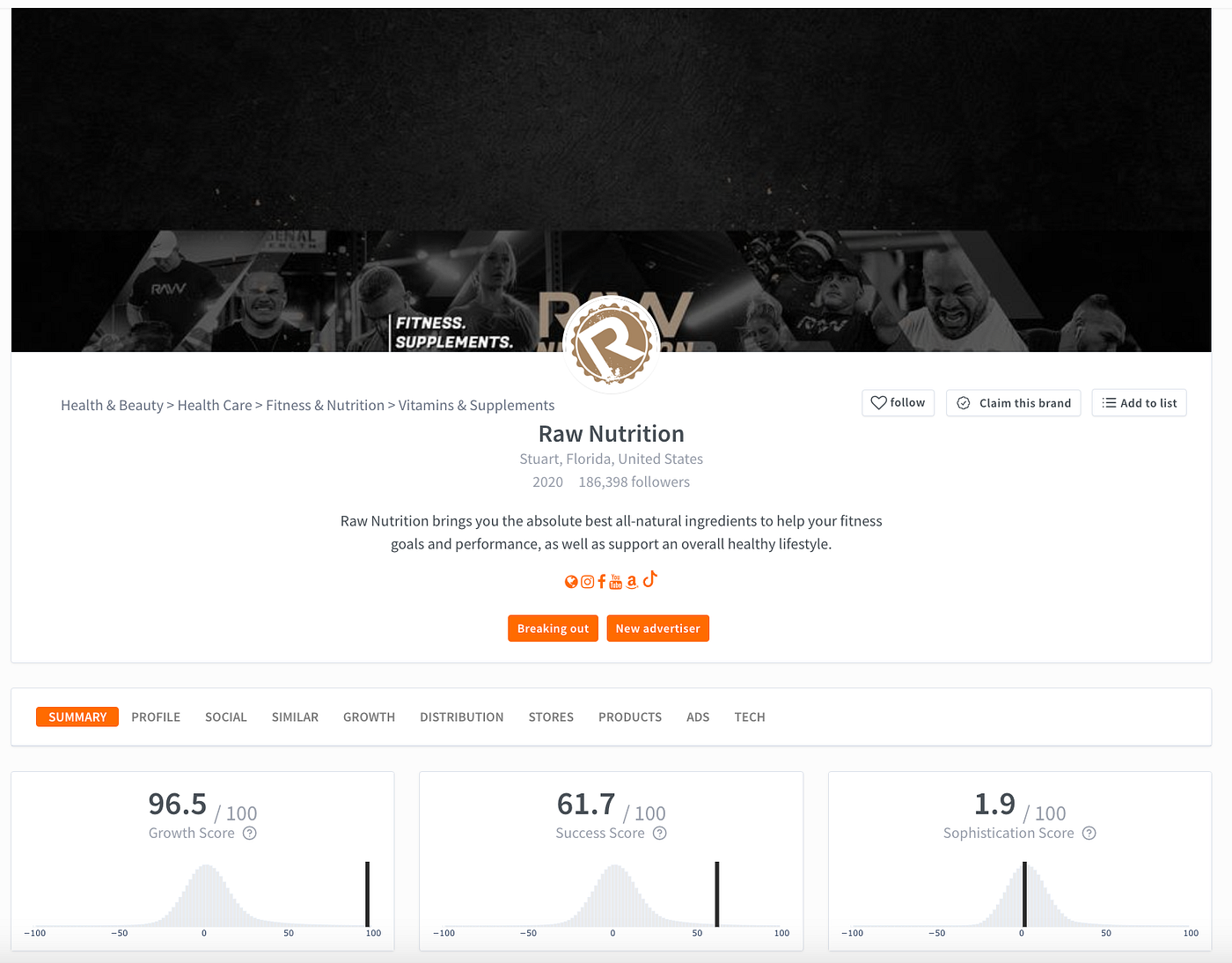

As people became more mindful of their health and the need for a strong immune system during the pandemic, the demand for DTC health products — especially vitamins and supplements — rocketed. Florida-based Raw Nutrition launched its line of all-natural products in 2020 in the middle of the COVID-19 crisis. The timing has paid off well for the brand, which focuses on helping customers achieve their fitness and personal goals and supporting healthy lifestyles.

Charm.io gives the company a 96.5 growth score based on impressive company metrics, including:

- 98th percentile — Instagram

- 94th percentile — Facebook

- 122% increase in website traffic over 6 months

- 44% Instagram growth in 6 months

More established brands like Liquid IV, which opened its doors in 2013, are also benefitting from the current focus on health and wellness. This electrolyte drink mix company aims to help people hydrate faster — the company’s slogan. Liquid IV has attained a growth rate of 92.9 and ranks in the 95th percentile on Facebook and 92nd on Instagram. The brand’s recent focus on TikTok has also led to 95% growth over the past 12 months. Diving deeper into the Charm.io insights, it becomes clear that Liquid IV has invested heavily in advertising, with the number of advertisements for the brand increasing 66% over the past year. Product visualization, workflow automation, customer retention, retargeting (including Snapchat and TikTok), and AWS and Cloudflare are just a few of the technologies listed in this company’s arsenal. That pairing of tech tools paints the picture that Liquid IV is honed in on what is vital to its revenue and growth goals — streamlined processes that deliver positive and engaging consumer experiences.

Dog Supplies

Direct-to-consumer categories have been increasingly led by pet-related products. The DTC pet food market alone is expected to reach $8.16 billion by 2028 at a compounding annual growth rate (CAGR) of 25.2%. It is easier than ever to create a life of comfort for our pets with readily available pet sitting services, high-quality foods and treats, and monthly boxes of new goodies to discover delivered right to our doors. As our bonds deepen, one thing is certain — pet parents want to keep their fur babies safe at all costs. That’s where two leading brands come into play.

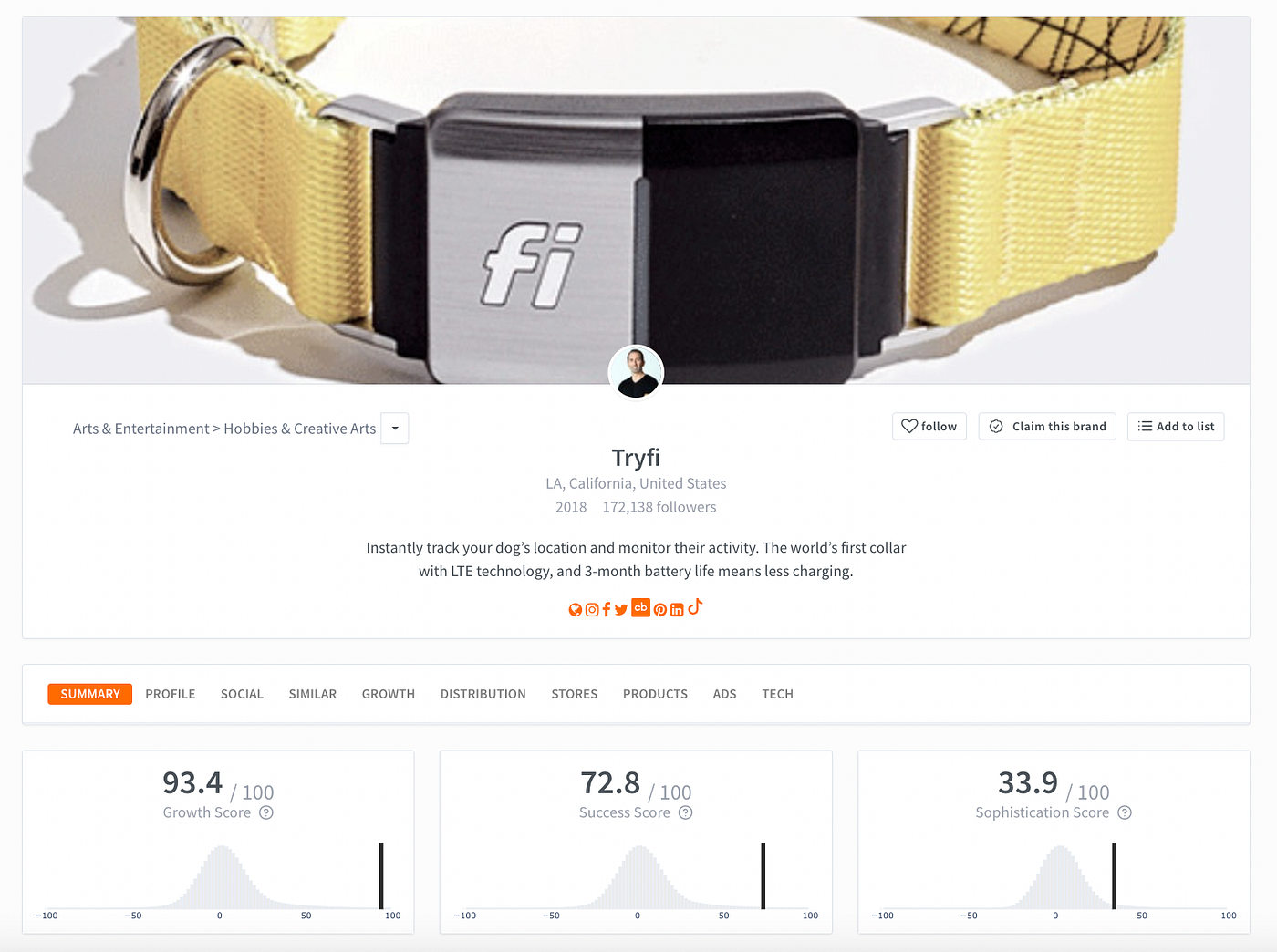

Tryfi provides LTE tech for pets. The device has a 3-month battery life and allows owners to track and monitor their pets, whether their pet is out for a walk with a dog sitter or is lost. The LA-based company has earned a 93.4 growth rate since its launch in 2018. Tryfi is in the 94th percentile for web traffic and 92nd percentile on Instagram.

Though Tryfi’s tech portfolio is small compared to other companies we’ve reviewed, they have clear priorities — retargeting through Facebook and Tiktok (two platforms that attract a lot of dog lovers), Paypal payments and marketing, AWS, and Google ads and tag manager. Tryfi also maintains its ads on a regular schedule of 3–8 days at a time, which can help to ensure it is in tune with This approach seems to be working based on the company’s steady growth of more than 45% in 12 months on Instagram and Facebook.

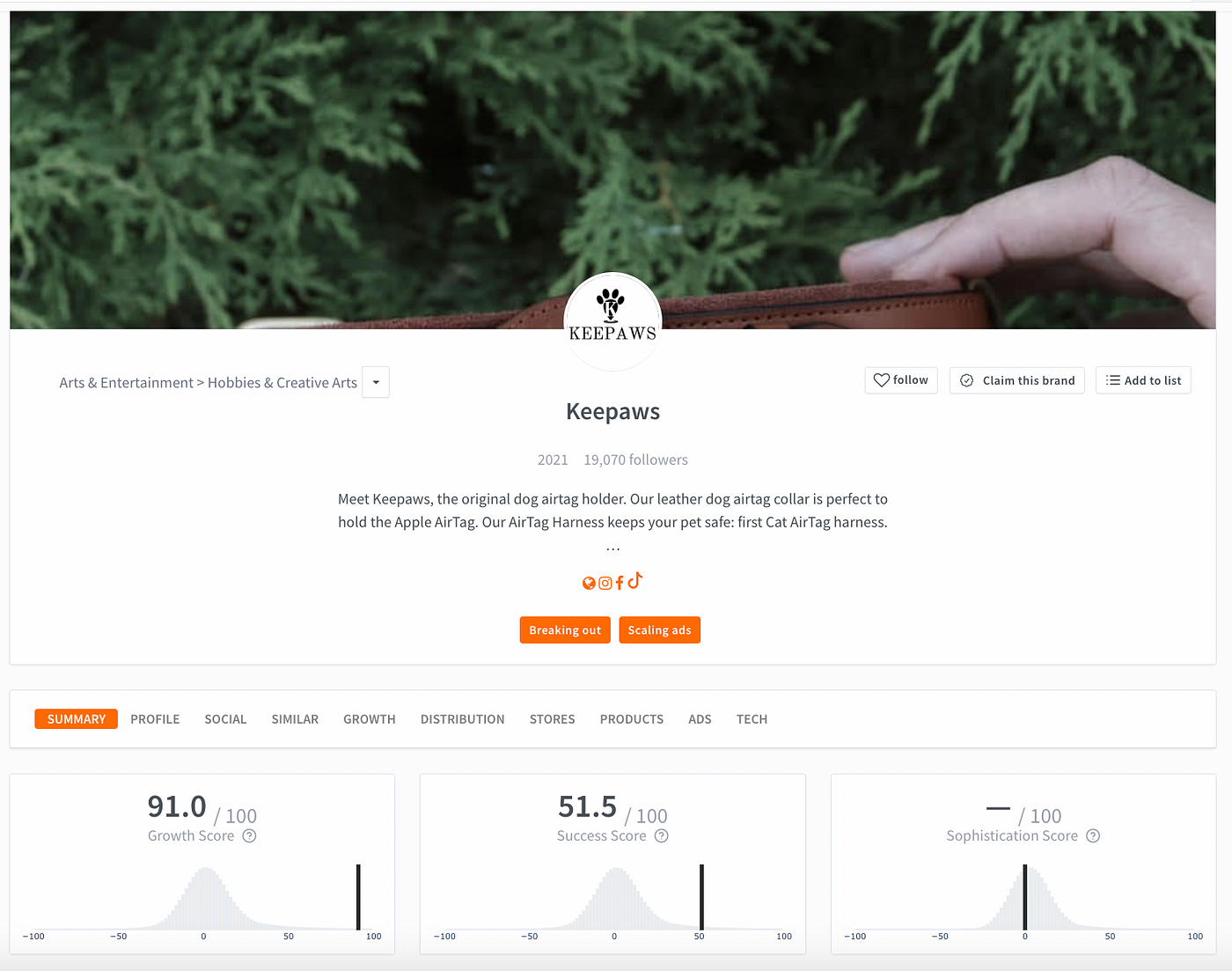

Keepaws sits in a similar corner of the dog supply category. The brand was founded in 2021 and sells collars and harnesses that hold air tags, so owners can easily track pets. The company has a 91.0 growth score and is in the 95th percentile for Instagram. From July to September 2022, Keepaws experienced 121% growth on Instagram and 77% web traffic growth. They also increased the number of ads they run by 26%.

Based on its tech stack, Keepaws has invested in online and SMS notifications, product recommendations, upselling/cross-selling, SEO and site optimization, and affiliate marketing. In other words, Keepaws seems laser-focused on attracting visitors, increasing their average purchase value while on the site, and staying top-of-mind through interactions on consumers’ mobile devices and favorite social channels.

Conclusion

Despite the challenges retail has faced during the pandemic, due to supply chain issues, and in the face of the highest inflation in 40 years, the DTC categories continue to thrive. When even luxury beauty brands like Chanelplan to make the shift to more of a DTC format, it is clear that the direct-to-consumer categories are doing something very right. With access to pertinent data, businesses, investors, and strategists can glean valuable insights into their own companies, competitors, and potential investments to make the informed decisions that drive real value.

Sign up for Charm.io to gain in-depth insights on any DTC Brand

Use Charm.io’s leading ecommerce intelligence platform for prospecting, brand research, and quick access to contact information for decision-makers and vital team members.

Questions about Charm?

Attend our monthly Charm webinar where our Customer Success Managers will show you how Charm can help you grow your business.

Sign up for the Webinar